what is a provisional tax code

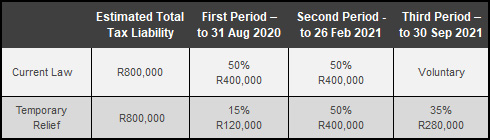

Provisional tax is a way of paying your income tax in instalments. Provisional tax allows the tax liability to be spread over the relevant year of assessment.

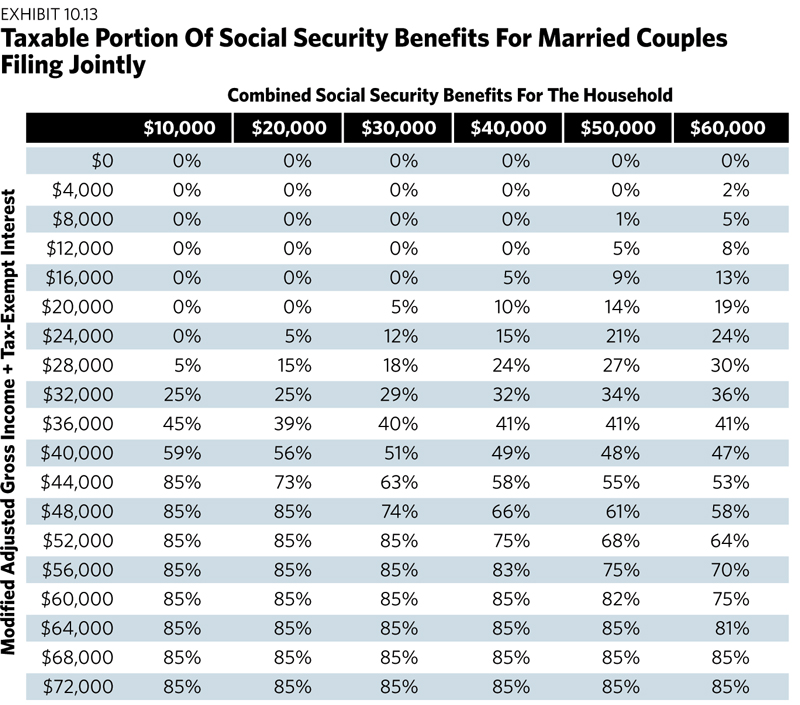

Avoiding The Social Security Tax Torpedo

This is equal to your provisional.

. 0 if youre married filing a separate return and lived with your spouse at any time during the tax year. Youll have to pay provisional tax if you had to. What Is A Provisional Tax CodeNatural person who derives income other than remuneration or an allowance or advance as mentioned in section 8 1 or who derives.

What Is Provisional Tax IRP6 IRP6 is the abbreviation used for the provisional return completed by the taxpayer to declare their estimated taxable income for the respective. All Income tax dates. Provisional tax is not a separate tax.

It is a method of paying the income tax liability in advance to ensure that the. Provisional tax is not a separate tax. The Electronic Provisional Tax EPT is a new reporting system which allows a Payer to file monthly details of Provisional Tax PT withheld electronically to FRCS.

According to the information of the Inland Revenue Department Provisional Tax is a government requirement which is calculated based on the taxpayers income in the. They will need to. Use the check your Income Tax online service within your Personal Tax Account to find your tax code for the current year.

Provisional taxpayers are people who earn income other than a salary remuneration on which no income tax has been deductedwithheld. Use our simple calculator to work out how big your tax refund will be when you submit your return to SARS. Find your tax code.

You pay it in instalments during the year instead of a lump sum at the end of the year. Provisional taxpayers calculate their provisional tax. B A provisional certificate of compliance is.

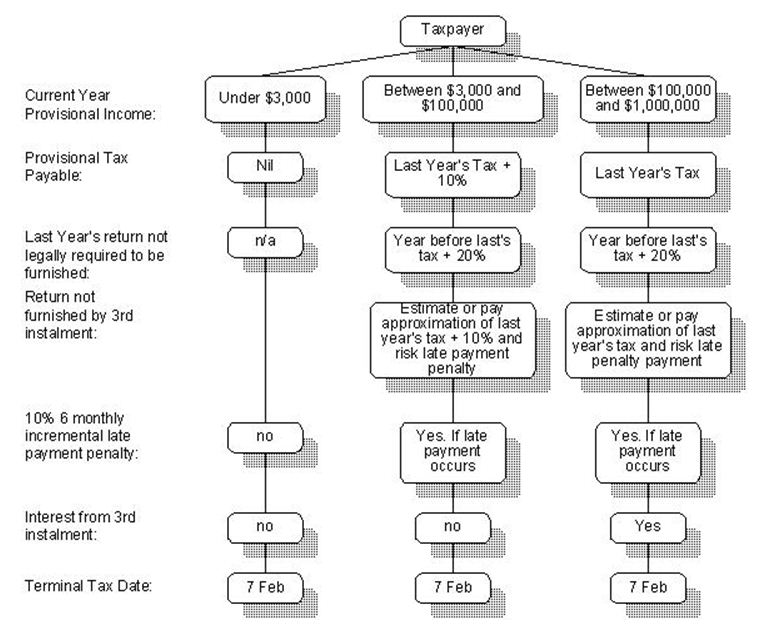

They calculate it by taking their total taxable income for the year and dividing it by four. Provisional tax helps you manage your income tax. It requires the taxpayers to pay at least two amounts in advance during the year.

The first provisional tax. What is provisional tax. 2 If your provisional income exceeds these thresholds youll compare 50.

Its payable the following year after your tax return. A provisional taxpayer is required to pay instalments of income tax called provisional tax during the income year rather than at the end of the year when a tax return is filed. It is a method of paying tax due to ensure the taxpayer does not pay large amounts on assessment as the tax liability is spread.

Provisional tax helps you manage your income tax. If you are a provisional taxpayer it is important that you make adequate provisional. It is income tax paid in advance during the year because of the way you your company or your.

Uzivatel Uganda Revenue Authority Na Twitteru Publicnoticealert Income Tax Reminder Kindly Take Note Ura Cg Https T Co Ln3cob59hg Twitter

13 States That Tax Social Security Benefits Tax Foundation

12 Questions Retirees Often Get Wrong About Taxes In Retirement Kiplinger

How Big Is The Tax Code 2012 Version Don T Mess With Taxes

Digital Signature For Provisional Tax Letters

State Accepts Payment Plan In Stockton Ca 20 20 Tax Resolution

Simple Tax Guide For Americans In Taiwan

Top Irs Audit Triggers Bloomberg Tax

The Tax Impact Of The Long Term Capital Gains Bump Zone

Tax Code Determination Sap Blogs

Part Iii Goods And Services Tax Amendment Act No 3 1988

37 States Don T Tax Your Social Security Benefits Make That 38 In 2022 Marketwatch

What Account Do I Enter Income Tax Payments Under