sales tax on leased cars in virginia

My monthly payment includes sales tax of 2453 total of 14958 for July - Dec. The rate is 415 but can be higher with the addition of local taxes.

Ferrari F12 Berlinetta Ferrari F12berlinetta Ferrari Berlinetta Ferrari F12

The vehicle is registered in the name of the leasing company and the car tax bills are sent directly to the leasing company for payment.

. Vehicles leased by a qualified military service member andor spouse will receive a 100 state vehicle tax subsidy PPTRA as a tax credit on the first 20000 of assessed value. In Fairfax county of instance its 6. According to Florida Tax rules 12A-1007 section 13 Lease or Rental.

Also the lessor may be known as a leasing company. For the purposes of the Motor Vehicle Sales and Use Tax collection gross sales price includes the dealer processing fee. The answer is yes in this situation you are unfortunately double taxed for the lease.

Sales tax in Virginia is levied on the ENTIRE value of the car not just the depreciation as is done in most other states. Virginia VA Sales Tax and Lease Purchase Option. But using the above example say the sales tax was 8 percent.

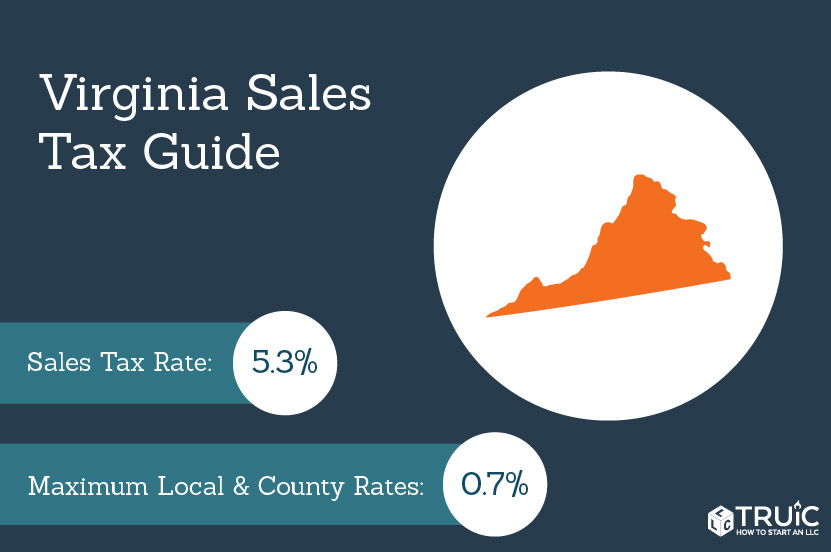

Would I have to pay the full 415 sales tax for the car upfront due at signing. For vehicles that are being rented or leased see see taxation of leases and rentals. The sales tax rate for most locations in Virginia is 53.

The tax applies to vehicles rented for less than 12 months regardless of what type of dealer you rent it from. Hancock County Chrysler Dodge Jeep Ram. Grocery items and cer tain essential personal hygiene items are taxed at.

Taxes up front at signed lease 27k 6. A tax on the rental of motor vehicles in Virginia. On or after January 1 2009 a tax is imposed upon the monthly payments for the lease of any motor vehicle leased under a written contract of lease by a resident of West Virginia for a contractually specified continuous period of more than thirty days which tax is equal to five percent of the amount of the monthly payment applied to each.

However when I bought the car at the end of the lease I had to. I itemize my deductions. The leased vehicle will be titled in the name of the lessor ownerAll applicable fees are due at the time of titling by the lessor such as the 10 title fee and the Motor Vehicle Sales and Use Tax which is 3 of the gross price of the vehicle.

In addition to taxes car purchases in West Virginia may be subject to other fees like registration title and plate fees. Unless they have recently changed the law in Virginia I dont think this is true. When a lease assumption occurs BMWFS still holds the title but when you buy the.

Power of Attorney POA A legal document granted to the selling dealership which gives the dealership the authority to handle all paperwork ie. In New York Minnesota and Ohio you pay tax up-front on the sum of lease payments see New York Car Leasing and Ohio Car Leasing for more details. Effective July 1 2016 unless exempted under Va.

West Virginia collects a 5 state sales tax rate on the purchase of all vehicles. The Virginia Department of Motor Vehicles states that there is a 4 percent sales tax rate for any vehicle that you purchase within state lines with the minimum sales tax for purchased vehicles. Generally the tax applies to leases or rentals of machinery and equipment which is leased or rented without an operator.

To learn more see a full list of taxable and tax-exempt items in West Virginia. In all of Virginia food for home consumption eg. Sales leases and rentals of motor vehicles are not subject to the retail sales and use tax provided they are subject to the Virginia motor vehicle sales and use tax administered by the Department of Motor Vehicles and.

For most passenger vehicles the motor vehicle rental tax equals 10 of the amount that you pay for the rental. Sales tax is a part of buying and leasing cars in states that charge it. In VA you are taxed up front on the cap cost of the leased car sales tax rate of 6Fairfax county and then 415 tax rate based on the value of the car each year.

This protects people who lease from having a spike in how much they owe if state sales taxes are increased The sales tax varies by state. If I end up with a leased car cap cost final sale price of 45k should I expect to pay the following. You can find these fees further down on the page.

Code 581-2402 Virginia levies a 415 Motor Vehicle Sales and Use SUT Tax based on the vehicles gross sales price or 75 whichever is greater. The sales tax for car-lease payments is based on the sales tax of the state where the car is leased at the time of the lease. Id like to lease car but Ive heard different things about how you pay the sales tax when leasing a car for registration in Virginia.

I leased a new vehicle in July 2017. Several areas have an additional regional or local tax as outlined below. This page describes the taxability of leases and rentals in West Virginia including motor vehicles and tangible media property.

Like with any purchase the rules on when and how much sales tax youll pay. Gross proceeds means the charges made or voluntary contributions received for the lease or rental of tangible personal property computed with the same deductions where applicable as for sales. In Virginia you pay full sales tax up front and receive no sales tax credit for your trade-in vehicle.

The tax is broken down into three parts. Titling registration etc for your leased vehicle. Now Florida is charging me monthly sales tax on the lease payments and since I didnt pay any tax in Virginia I am not due any credit.

Depending on the county in which you live you may also pay a personal property tax that strangely is billed to you twice a year. A Virginia licensed vehicle dealer may be considered the vehicle lessor for purposes of the Motor Vehicle Sales and Use Tax exemption. The way it was explained to me is that the 3 is a title tax.

I assumed a lease in 2003 and did not have to pay tax. While West Virginias sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

Do I Have To Pay A Car Tax On A New Or Used Car Credit Karma

Car Donations For Cash Car Donate Bmw Car

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Virginia Vehicle Sales Tax Fees Calculator

What S The Car Sales Tax In Each State Find The Best Car Price

Which U S States Charge Property Taxes For Cars Mansion Global

Top 5 Best Car Rental Company Car Rental Company Hertz Car Sales Car Rental

Virginia Vehicle Sales Tax Fees Calculator

Zurich Car Insurance Quote Malaysia 2021 Insurance Quotes Car Insurance Auto Insurance Quotes

Virginia Sales Tax Small Business Guide Truic

Newbest Of Self Employed Tax Deductions Worksheet Check More At Https Www K Chemistry Worksheets Science Teaching Resources Reading Comprehension Worksheets

What S The Car Sales Tax In Each State Find The Best Car Price

What Do You Pay For Wear Tear On A Leased Car Used Car Dealer Refinance Car Taxi Driver

Virginia Vehicle Sales Tax Fees Calculator

Car Lease Calculator Get The Best Deal On Your New Wheels Nerdwallet

Income Tax Prep Checklist Free Printable Checklist Tax Prep Checklist Tax Prep Business Tax Deductions