how to pay late excise tax online

The tax collector must have received the payment. You must select the Form of Payment.

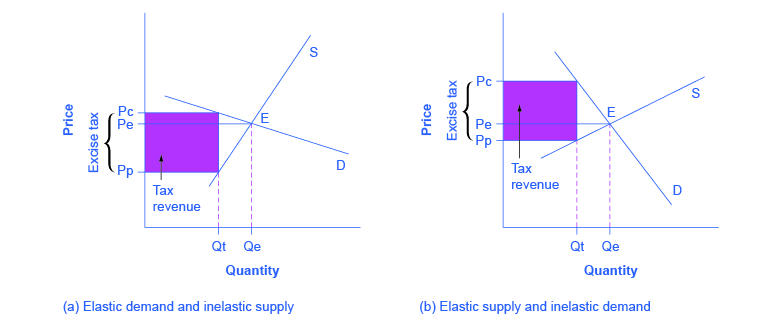

Elasticity And Pricing Principles Of Economics 2e

Online payments for excise tax are accepted only within the 30 days from the date of issue on the original tax mailed.

. Submit the form and payment if required. There is no statute of limitations for motor vehicle excise bills. If your vehicle isnt registered youll have to pay personal property taxes on it.

Sequentially number your excise tax returns for the entire calendar year and start your serial numbers over at 01 at the beginning of each calendar year. Notice 2021-66 provides an initial list of taxable chemical substances and guidance for registration with the Form 637 Application for Registration For Certain Excise Tax Activities. You can pay tax penalties and interest using Revenue Online.

The penalty rate is 5 percent per month or part of month up to maximum of 25 percent computed on the amount of tax required to be shown on the return. The request must be made before the due date. Quarterly Excise Tax Payment Procedures.

We will then present bills found matching the options you provided. You pay an excise instead of a personal property tax. Toll-free in Massachusetts Call DOR Contact Toll-free in Massachusetts at 800 392-6089.

Online payments will have a NON-REFUNDABLE 45 convenience fee added to your total. You can make a payment with your Visa Debit or Interac Online debit card through the My Payment service. Tax Department Call DOR Contact Tax Department at 617 887-6367.

Find your bill using your license number and date of birth. If payment is still not received a warrant fee of 1000 will be added. To learn more about the differences between the GET and sales tax please see Tax Facts 37-1 General Excise Tax GET.

Get tax due dates. You can mail your check or money order tax payment. You are personally liable for the excise until the it is paid off.

Personal property taxes are due May 5 and October 5. File or amend my return. The Legislature also authorized county governments.

Excise Bills are issued numerous times throughout the year when received from the Registry of Motor Vehicles and are due 30-Days after the issue dateFor Vehicles on the road January 1 that have paid an excise tax in the prior year those bills are generally issued by February 15. Situs means the place to which for purposes of legal jurisdiction or taxation a property belongs. If you are not sure which form you need please visit Business Central to check your filing responsibilities.

Contact Us Your one-stop connection to DOR. File a permit application to receive approval to operate a TTB-regulated business. You will do this with Hawaii Business Express Website.

Please use this page to search for delinquent motor vehicle excise tax bills. Pay by pre-authorized debit You can set up a pre-authorized debit agreement and eliminate the need for postdated cheques. Fill out the form you need to file.

Once they receive payment from you. The taxes will be reported on Form 720 Quarterly Federal Excise Tax Return and Form 6627 Environmental Taxes. Personal property tax rate.

Item 2 - Form of Payment. Select from commodity type and product. MassTaxConnect Log in to file and pay taxes.

Once you enter your NAME please CLICK one of the options below to continue entering specific information. Residents who own motor vehicles have to pay taxes based on the value of their vehicles each year. If you are unable to find your bill try searching by bill type.

The excise is based on information furnished on the application for registration of the. Download permit application and informational packets. A late filing penalty of 5 per month or partial month up to a maximum of 25 of the tax that is reported on the tax return.

Excise Tax on Coal. If you mail your payment and return separately include Form OR-20-V Oregon Corporation. File by mail if you have a waiver.

Depending on the circumstances the Department may grant extensions for filing an excise tax return. You can pay any tax bill with a check or money order by dropping your payment in the outside drop box located in the Town Hall parking lot just to the left of the handicap parking spaces Please enclose the payment stub andor make note of the bill number on your check. Pursuant to Massachusetts General Law Chapter 60 Section 15 a demand fee of 2500 will be added.

The city or town where the vehicle is principally garaged levies the excise and the revenues become part of the general funds of the municipality. Majority of bills are due in late March or early AprilMotor Vehicle Excise Tax bills are issued each calendar year to each owner of a vehicle registered in Massachusetts. Get excise tax rates.

How do I pay for overdue excise taxes that have been marked at the Registry of Motor Vehicles for non-renewal. They also have multiple locations you can pay including. Excise tax return extensions.

Payment at this point must be made through our Deputy Collector Kelley Ryan Associates 508 473-9660. Be sure to submit your filings and payments on time. There are plenty of free tax services online to help you file your return.

You must file an excise tax return for every excise tax period even if your tax liability is 000 unless you are a qualifying winery. Not just mailed postmarked on or before the due date. Internal Revenue Code 4121.

IRC 6651 a 1 imposes a penalty for the failure to file a tax return by its required due date determined with regard to any extension of time for filing. All Massachusetts residents who own and register a motor vehicle must pay the motor vehicle excise annually. File the Hawaii General Excise Tax Return.

Filing frequencies due dates. Get your bill in the mail before submitting online. Tax classifications for common business activities.

The Department can waive late return penalties under certain circumstances. A motor vehicle excise is due 30 days from the day its issued. A vehicle has situs for taxation in the county or if it is registered to a county address with the Virginia Department of Motor Vehicles.

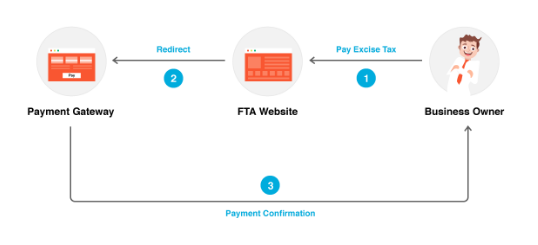

Create account on Paygov. Hawaii requires businesses to file general excise tax returns and submit excise tax payments online. Once completed click the NEXT button within the option you choose.

File TTB form on Paygov. 9 am4 pm Monday through Friday. Select the TTB form you want to file.

Plan for and pay your taxes. Schedule for semi-monthly quarterly and FAET filers. The tax rate is 015 for Insurance Commission 05 for Wholesaling Manufacturing Producing Wholesale Services and Use Tax on Imports For Resale and 4 for all others.

Online Bill Payments City Of Revere Massachusetts

Gst Migration Registration For Existing Assessee Registration Consent Letter Patent Registration

Motor Vehicle Excise Tax Wellesley Ma

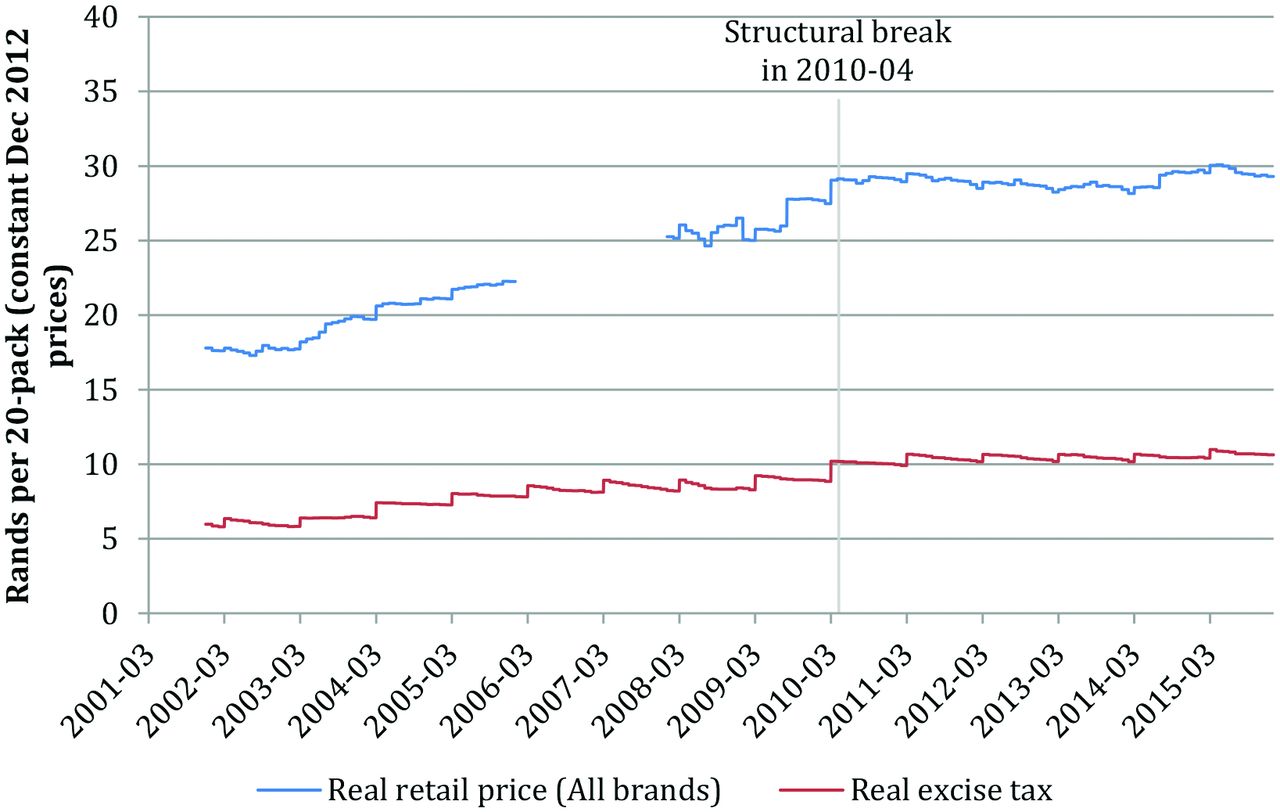

The Effect Of Excise Tax Increases On Cigarette Prices In South Africa Tobacco Control

Pin By Karthikeya Co On Tax Consultant Prosecution Solutions Relief

Look Up Pay Bills Town Of Arlington

Top Benefits By The Best Gst And Income Tax Service Providers In 2022 Filing Taxes Online Taxes File Taxes Online

Different Types Of Australian Taxes Types Of Taxes Tax Services Business Advisor

Online Bill Payment Town Of Dartmouth Ma

Excise Tax Return Filing And Payment Zoho Books

Tax Collector Frequently Asked Questions Town Of North Providence Rhode Island

Corporate Excise Tax Penalties Waived S Corporation Efile Irs

Sample Tax Notice Response Valid Prettier Models Irs Response Throughout Irs Response Letter Template 10 Profe Letter Templates Lettering Name Tag Templates

The Real Deadline For Depositing 401 K Deferrals And What To Do If You Re Late Www Patriotsoftware Com Payroll Software Deposit Employment

Federal Excisetax Form2290 Quarterly Federal Excise Tax Form720 International Fueltax Agreement Report Ifta All These Tax Deadline Filing Taxes Tax

All About Gstr1 And Updates Income Tax Return Income Tax Professional Accounting

Digital Tax Stamp Businesses Must Comply With New Excise Tax Norm Digital Tax Consulting Business Chartered Accountant