does cash app report to irs for personal use

Cash App SupportTax Reporting for Cash App. Cash app users need to know this new rule only applies to business transactions.

Income Reporting How To Avoid Undue Taxes While Using Cash App Gobankingrates

Starting this year however if youre paid.

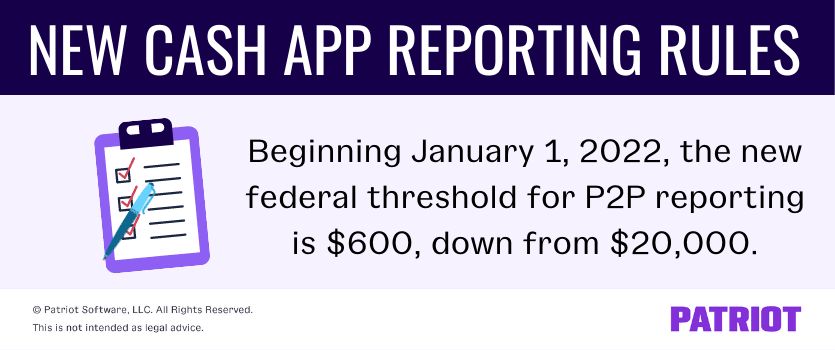

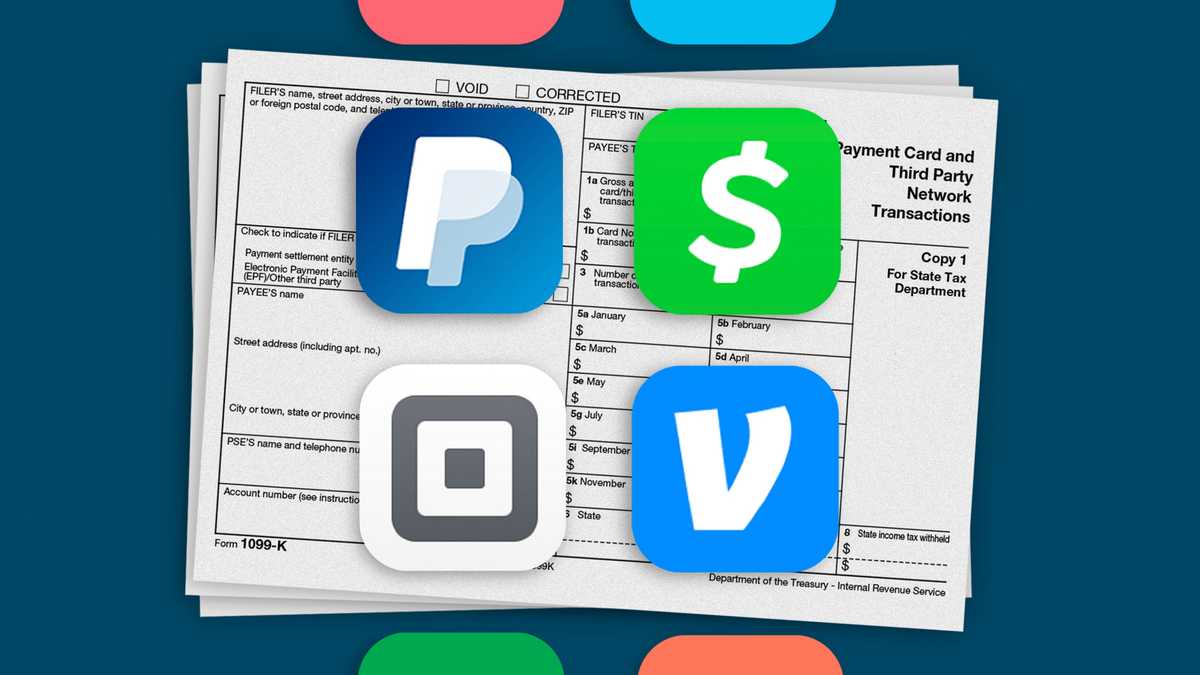

. 1 2022 people who use cash apps like Venmo PayPal and Cash App are required to report income that totals more than 600 to the Internal Revenue Service. The irs wont be cracking down on personal transactions but a new law will require cash apps like venmo zelle and paypal to report aggregate business transactions of 600 or more to the irs. 1 mobile payment apps like Venmo PayPal and Cash App are required to report commercial transactions totaling more than 600 per year to the Internal Revenue Service.

If youre self-employed or have a side hustle youre probably no stranger to paying estimated taxes. Certain Cash App accounts will receive tax forms for the 2021 tax year. Registration is a piece of cake and you can use your contacts or email addresses to find your friends.

For any additional tax information please reach out to a tax professional or visit the IRS website. Yes you can use cash app for the tax refund deposit. The previous threshold was 20000.

VERIFY previously reported on the change in September when social media users were criticizing the IRS and the Biden administration for the change some claiming a new tax would be placed. Many people use Venmo strictly for personal transactions the company reports that the average payment amount is 60. New Cash App Tax Reporting for Payments 600 or more Under the prior law the IRS required payment card and third party networks to issue Form 1099-K to report certain payment transactions that met.

Whos covered For purposes of cash payments a person is defined as an individual company corporation partnership association trust or estate. It says a new law that took effect January 1 applies to small businesses to make sure they pay their fair share of taxes. Cash App Investing is required by law to file a copy of the Form Composite Form 1099 to the IRS for the applicable tax year.

Tax Reporting for Cash App. Open separate P2P accounts for business and personal use to make reporting easier Be ready to provide your taxpayer identification number eg Employer Identification Number to the cash app so they can report it on Form 1099-K Keep detailed records of your own to compare to the information you receive on Form 1099-K. The app will notify the IRS for business transactions and generate a 1099K formFinancial experts recommend using one app for business and one for personal that way things will be separate and.

10 2022 Published 123 pm. It allows you to easily split rent with your. Any errors in information will hinder the direct deposit process.

That includes millions of small business owners who rely on payment apps like Venmo PayPal and Cash App and who could be subject to a new tax law that just took effect in January. As long as your account is under your real name and correct address. So no the IRS is.

Zelle IRS Rules Are Changing in 2022 No New Taxes Are Due. The new rule which took effect. Cash apps like Venmo Zelle and PayPal make paying for certain expenses a breeze but a new IRS rule will require some folks to report cash app transactions to the feds.

The IRS wont be cracking down on personal transactions but a new law will require cash apps like Venmo Zelle and Paypal to. Here are some facts about reporting these payments. The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or PayPal transactions over 600.

How do I calculate my gains or losses and cost basis. Can you report on cash App. Those using apps to send money for personal reasons to purchase items or pay bills will not be affected.

IRS Tax Tip 2019-49 April 29 2019 Federal law requires a person to report cash transactions of more than 10000 to the IRS. By Tim Fitzsimons As of Jan. If you use payment apps like Venmo PayPal or CashApp the new year ushered in a change to an IRS tax reporting rule that could apply to some of your transactions.

The IRS wont be cracking down on personal transactions but a new law will require cash apps like Venmo Zelle and Paypal to report aggregate business transactions of 600 or more to the IRS. As of January 1 the IRS will change the way it taxes income made by businesses that use Venmo Zelle Cash App and other payment apps to receive money in. The app is simply a digital wallet connecting to your payment methods.

Log in to your Cash App Dashboard on web to download your forms. Margarita Murphy says she uses cash app transactions to pay her rent. Your gains losses and cost basis should automatically be calculated on a first-in-first-out basis on your 1099.

If you receive a suspicious social media message email text or phone call regarding the Cash App or see a phone number that you believe is. Zelle a third-party payment app that enables convenient mobile transactions. There Is NO 600 Tax Rule For Users Making Personal Payments On Cash App PayPal Others.

Changes To Cash App Reporting Threshold Paypal Venmo More

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

To Win At The Tax Game Know The Rules Published 2015 Tax Forms Irs Tax Forms Income Tax

Venmo Paypal And Cash App To Report Payments Of 600 Or More To Irs This Year What To Know Larson Accouting

Ir 2022 08 January 10 2022 The Irs Announced That The Nation S Tax Season Will Start On Monday January 24 2022 When The Ta In 2022 Tax Deadline Filing Taxes Irs

All About Forms 1099 Misc And 1099 K Bookkeeping Business Business Tax Organization Solutions

The Times Group Filing Taxes Changing Jobs Online Surveys

Pin By Jessica Hufford On Money Tax Prep Checklist Tax Checklist Tax Preparation

Form 1040 Sr U S Tax Return For Seniors Definition Tax Forms Irs Tax Forms Ways To Get Money

Changes To Cash App Reporting Threshold Paypal Venmo More

Irs Has New Ways Of Taxing Cash App Transactions

Fillable Form 1040 Individual Income Tax Return Income Tax Tax Return Income Tax Return

Pin By Dominique Rogers On Organize Life Tax Deductions Property Tax Rental Property

Printable And Fileable Form 1099 Misc For Tax Year 2017 This Form Is Filed By April 15 2018 Irs Forms Fillable Forms 1099 Tax Form

Documentation Beats Conversation Every Time If You Have Irs Tax Debts Contact Me I Service The Entire U S Business Tax Small Business Tax Irs Taxes

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules